Learning by way of teaching others is a pedagogical approach whereby people improve their very own understanding of a topic by instructing peers. This method posits that the act of teaching solidifies one’s information and promotes comprehension, as it necessitates a deep engagement with the material. Without these supports, learning to show well is extraordinarily tough. There are thousands of math web sites that can be utilized as a part of a game-based learning method or differentiation strategy. Online sources get students enthusiastic about studying math and may usually be scaled primarily based on knowledge and grade degree. According to research from 2006, teachers overwhelmingly reported an absence of professional development help when it got here to bettering their very own classroom management strategies.

Unlike these two information classes, the teachers didn’t seem to achieve material information or knowledge of the context from educating, as indicated by the low frequency of these classes. In addition, the frequency of the PCK and GPK codes for the second day of every unit was decrease than that for the first day of instructing, suggesting that academics discovered probably the most after they began a model new unit. We’ve journeyed via the wealthy landscape of what makes instructing truly effective—from setting crystal-clear learning aims to embracing reflective apply as your personal development engine. The 7 components we’ve unpacked aren’t just theoretical ideals; they are sensible, research-backed pillars that each educator can build upon to transform their lecture rooms. Every classroom is a mixed bag of learning types, readiness levels, and interests. Teaching to the middle means leaving some college students behind and others bored.

One approach to promote digital citizenship in your next unit of instruction/project/lesson, etc. How to use question/answer stems to advertise stronger dialogue with and between students. In response, beneath I’ve collected 20 (mostly) simple things you can do (relatively) shortly to turn out to be a greater trainer. The record is purposely diverse as a result of I wrote it and can’t keep targeted on anything for longer than 4 minutes, it appears.

This collaborative factor builds a supportive environment the place college students check their understanding before speaking publicly. The second step to promote personal growth and lifelong studying is to problem your learners. Challenge them to use their learning to real-world problems and conditions. By challenging your learners, you presumably can stimulate their curiosity, engagement, and enthusiasm. You can also assist them develop a progress mindset, where they see challenges as opportunities to be taught and improve.

By fostering a love for learning, we set our students on a path for lifelong exploration. It reminds us as educators to domesticate a positive setting where creativity thrives. Every interplay we have with our students carries the possibility of instilling highly effective lessons. We have the chance to information students towards good values, resilience, and critical considering, shaping them into successful people in life.

It is time to begin earning from all of your input and efforts and make a difference in students’ lives. If you take the fast-tracking route into teaching, you’ll be granted full certification upon finishing your different program. The licensure allows you to teach instantly on completion underneath the supervision of an skilled teacher. The clear benefit of this route is its pace; it’s often the quickest way to begin working as a full-time instructor. It permits you to “earn while you be taught,” receiving a full wage and advantages whereas concurrently finishing your coursework and exams to turn out to be a totally licensed educator.

Teacher coaching can help current educators develop teaching skills or move into new roles. Those excited about an education profession outdoors of the classroom can also profit from instructor coaching programs. Keep reading to learn extra about trainer coaching programs and job opportunities. From January 2016 to July 2022, thirteen interviews had been carried out with 11 PGY2s from 9 academic hospitals.

Remember that motivation is vital and attempt to be patient so as to avoid introducing any unfavorable associations with college and studying. Remember to share progress updates with students frequently, celebrating their growth and addressing challenges constructively. This suggestions loop creates a supportive surroundings the place college students really feel motivated to have interaction in collaborative studying actions. To implement these tools successfully, begin small with one or two purposes that align together with your learning goals.

Fair participation administration ensures every scholar contributes, building a extra inclusive educational area for all. Classroom norms supporting risk-taking show important for academic success. Students who feel comfy making errors have interaction with difficult material more effectively. Successful implementation happens when teachers demonstrate their own pondering, making their psychological processes visible to college students. Through this modelling, students undertake related approaches for his or her learning challenges.

However, evaluating combined pedagogical methods can present challenges. Despite this, proof supports the concept constructivist ideas play a big function in efficient training. Children actively have interaction with materials, creating a dynamic studying surroundings where they build information by way of exploration and discovery. The future of learning by way of educating is poised for important transformation, significantly with the rise of technology-enhanced schooling. As on-line platforms and digital assets evolve, they may facilitate more interactive and collaborative studying experiences. This shift will promote an setting the place learners can successfully train each other, enhancing their mastery of subject matter.

Each should take lower than two minutes and give clear perception into scholar understanding. If college students battle, have a backup clarification or extra examples ready. Plan specific moments to verify understanding earlier than, during, and after instruction. This selection retains college students engaged and meets different learning preferences.

It is so essential that as an educator, you create an environment where play is the main target. According to great philosophers who paved the greatest way for us in schooling, corresponding to Jean Piaget, Maria Montessori, Arnold Gesell, and Lev Vygotsky, we study that play is significant to a child’s development. Vygotsky taught us that when a toddler is engaged in pretend play, they act as if they’re a head taller than themselves. This can solely be accomplished properly by providing the “blank canvas” for our younger learners and handing them the “paintbrush” (as opposed to something restrictive like a color-by-number!).

“The world exterior the classroom is an thrilling resource,” Brandt explains. By instilling confidence and inspiring open dialogue, we are able to shape future leaders and create a sequence response of positivity and change for generations to return. We should prioritize these essential skills in our curriculum, making certain that they turn into adept thinkers and communicators. This basis will allow them to sort out challenges and succeed in varied elements of their lives. Our responsibility is profound, as we foster their goals and encourage them to embrace their distinctive journeys.

However, on-line teaching platforms and course marketplaces aren’t without their merits. Teaching on-line isn’t just a sensible approach to scale your income — it’s one of the most versatile and sustainable paths to building a model that grows with you. Beyond that, I’ve helped shoppers construct and promote their very own online platforms, and I’ve taught online myself — each as a coach and course creator. I’ve seen the messy middle, the tech struggles, the technique gaps, and the small shifts that make an enormous distinction. I hope you discovered this text useful, I realize it reminded me of a great few issues that I could have been slacking with. Feel free to share it together with your instructor pals, I’m sure they’ll recognize it.

Why is it that, in spite of the fact that educating by pouring in, learning by passive absorption, are universally condemned, that they’re still so entrenched in practice? That schooling isn’t an affair of “telling” and being informed, but an active constructive process is a precept virtually as generally violated in apply as conceded in concept. Is not this deplorable scenario because of the truth that the doctrine is itself merely told? But its enactment in practice requires that the college setting be geared up with businesses for doing … However, perception is unpredictable—it’s not one thing that may be simply managed or forced.

With peer tutors, BYOD policies, and embedded professional growth, you’ll find a way to chip away at these obstacles. And don’t forget, the lengthy run is bright with AI co-teachers and immersive AR just around the corner. While statement could be a highly effective mode of learning, it’s necessary to assume about its limitations. Teachers should encourage active engagement, like asking questions and prompting discussions, to guarantee that college students can apply what they’ve observed. Learning by statement is among the most pure and earliest types of studying.

An essential guide on your Kindergarten to Grade 5 students to develop their information of necessary terminology in math. Anyone who’s created slides for their college students will be conversant in the challenge of imparting info via words and footage. Interleaving with connected subjects (e.g. division and multiplication) amplifies this impact. Tied into questioning within the classroom, elaboration places the onus on college students to do more than “just” recalling data.

That’s an oversimplified description of the flipped classroom approach, by which college students watch or learn their lessons on computer systems at residence after which complete assignments and do problem-solving exercises in class. These rules are also understood inside UDL as approaches that, respectively, account for learning inquiries like “affective” (why?), “recognition” (what?), and “strategic” (how?). These spheres are versatile sufficient to modulate the level of challenge and positive experience within the classroom, providing for a dynamic curriculum to handle comprehensive scholar wants.

This allows us to offer articles with interesting, related, and accurate information. Carefully think about these challenges and acquire the required skills and adaptability for successful on-line instruction. In recent years, there has been a major shift in direction of online learning. Students who understand how to learn will have extra persistence with themselves and others as they grasp new material. Never before in human history has there been such unparalleled access to information and data.

By sharing personal experiences and concepts, students can create a group the place they will study from each other, expanding their concepts by way of the experiences of others (Curry In overcrowded classrooms, one trainer may struggle to build significant relationships with every scholar. Limited individual consideration can leave some learners feeling unseen and reluctant to participate. When college students imagine their questions or contributions won’t receive genuine suggestions, they maintain again, reinforcing disengagement and ruining even the strongest scholar engagement strategies. Formative assessment supplies real-time suggestions on scholar understanding, permitting lecturers to adjust instruction promptly. Techniques like fist-to-five, traffic gentle cards, or quick quizzes help establish misconceptions early.

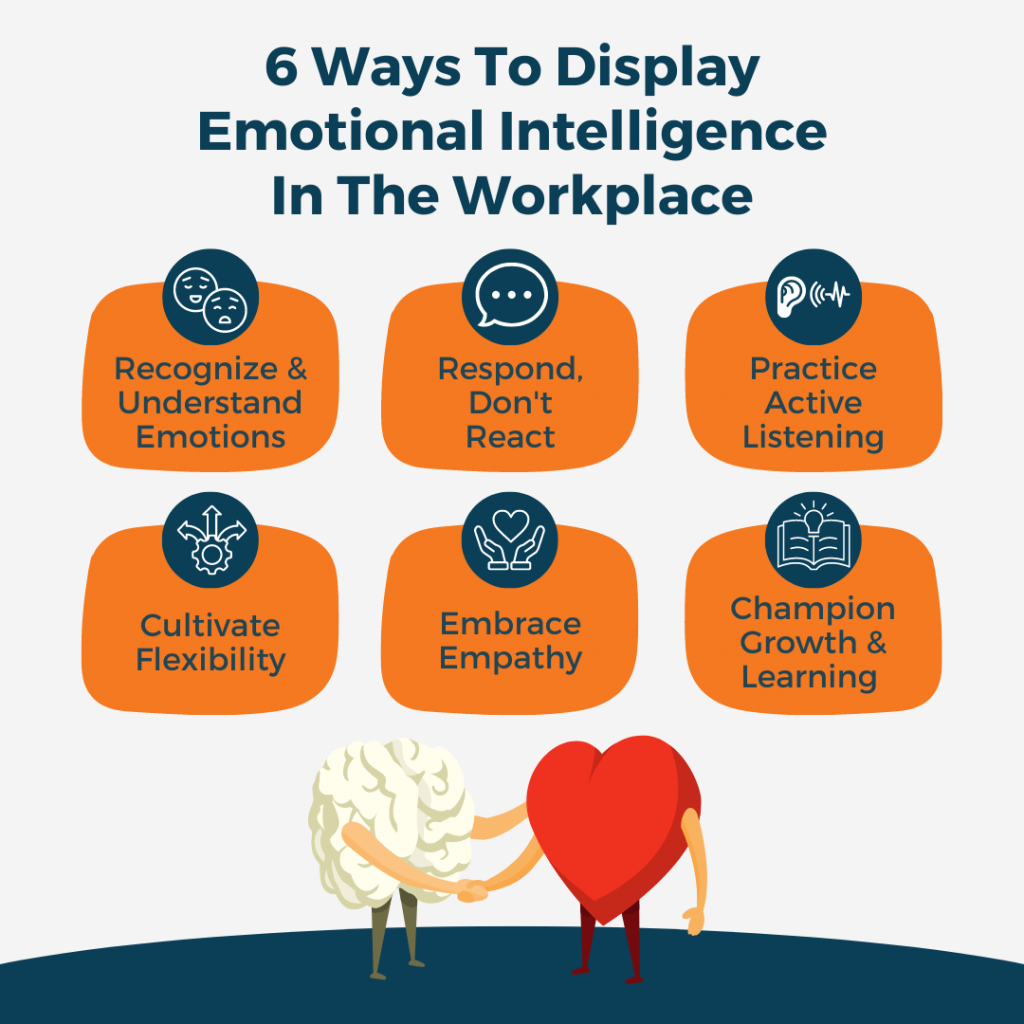

This method cultivates empathy, as educators typically turn into extra conscious of various learning types and challenges confronted by others. By partaking with various perspectives, people improve their emotional intelligence, resulting in more meaningful connections. Such interactions can bolster collaborative skills, aiding in each private relationships and teamwork in professional environments. Additionally, group dynamics can play a pivotal role in how individuals perceive and embrace learning.

By using interactive discussions and real-life examples, lecturers help students see how what they’re studying applies to the world round them. Today’s educating must embrace strategies like brainstorming classes, where students can suppose critically and creatively, getting them prepared for all times outdoors the classroom. It’s about making learning an lively, partaking process that truly prepares students for the actual world.

After deciding to maneuver into training, Chris worked in the English division of his native secondary college, main on interventions for essentially the most in a position college students. Chris spent two years instructing full-time, later transferring into supply educating, which he has accomplished at both major and secondary age. Most recently, Chris created content material for an online education platform, alongside his other work tutoring and freelance writing, where he specialises in schooling and sport. Good teaching practices aren’t just strategies, they’re habits you build over time. When you’re organized, you can concentrate on educating rather than looking for sources or fixing last-minute issues. Staying organized additionally means maintaining track of student progress and adjusting strategies when wanted.

Such suggestions can spotlight areas needing improvement and establish profitable educating strategies. When a learner makes an attempt to show others, they could struggle to convey info to peers who have totally different baselines of information. This discrepancy can hinder collaborative learning experiences, as these with a stronger grasp of the topic could inadvertently overlook important ideas that others need clarified. Overall, the cognitive benefits of educating others create a sturdy foundation for educational and private growth, making it a vital strategy in efficient studying environments.

This can lead to alternatives for talking engagements, collaborations, and other avenues to showcase your expertise. For occasion, if you quiz yourself on a subject you’ve just realized, you are strengthening your memory of that info and making it simpler to recall sooner or later. This process not only helps you keep knowledge better but also identifies areas the place you could must review or probe deeper into the fabric.

Practice by doing makes material extra private, and thus extra meaningful to students. Practice by doing also leads to more in-depth understanding of fabric, greater retention and higher recall. Discussion, or “Group Discussion”, is a form of Cooperative Learning.

Shortform has the world’s best summaries and analyses of books you should be reading. By far, crucial part of our brains taking in new stimuli is visible. Information that’s organized spatially is put into classes primarily based on its location. You can use this technique to organize info in a pocket book, textbook, or exam. For instance, you might draw arrows from associated info or mark the textual content with notes about the place each subject appears on an exam (e.g., “The first question about photosynthesis shall be here”). Students who study best visually may really feel that they battle to know verbal lectures and discussions.

To successfully activate prior information, academics can employ varied methods corresponding to pre-assessment, brainstorming periods, or K-W-L charts (What I Know, What I Want to Know, What I Learned). Blended studying combines conventional face-to-face instruction with online studying. Here’s a comprehensive list of 45 proven classroom educating strategies that our staff at Teacher Strategies™ swears by. Powerful professional growth choices can be found to boost your GOLD efficacy and enhance learning outcomes.

Teachers can create a classroom tradition that celebrates these moments, perhaps by way of a “wins of the week” board, verbal acknowledgments, or small rewards. This quote acknowledges the individuality of every scholar and affirms that studying isn’t a one-size-fits-all method. As educators, we should always have fun these differences and adapt our instructing types to accommodate numerous studying preferences. This quote illustrates the immense value of instructing inside society. It means that educators hold a particular place as the driving force behind knowledge and innovation. As lecturers, we must be proud of the pivotal position we play in shaping the subsequent era.

There’s an entire toolbox stuffed with great teaching concepts ready to be discovered! In this blog, we’ll delve into the thrilling world of creating your classroom a spot where college students thrive! We’ve all heard the saying, “Knowledge is power.” Here, we’ll explore the instructing and learning concepts, the method concerned, and strategies to make the classroom a dynamic house for studying experiences. Addressing data gaps within the context of studying via instructing others includes figuring out areas where each teachers and learners lack understanding. This process fosters a extra profound comprehension of the subject material and permits efficient knowledge switch.

Our findings point out that the work of instructing holds rich opportunities from which lecturers can learn. This research was guided by the three aforementioned research questions. To reply the primary question, which was how the teachers developed data by way of teaching, we reported the frequencies of additional codes assigned for every knowledge category after every instructing day.

Teaching values, empathy, and ethics creates well-rounded people who contribute positively to society. OpenLearn works with other organisations by providing free programs and resources that support our mission of opening up educational alternatives to more individuals in more places. Emily discovered her love of reading and writing at a younger age, learning to take pleasure in these activities due to being taught them by her mom—Goodnight Moon will forever be a favorite.

An effective teaching technique acknowledges this variety and adapts. Differentiated instruction means adjusting content material, process, and product based on individual pupil wants, studying types, and readiness ranges. This ensures that the material is neither too easy (leading to boredom) nor too onerous (leading to frustration). We’ll dive deeper into this later, however it’s a cornerstone of engagement. Ever questioned why some school rooms buzz with vitality whereas others feel like a snooze fest?

Sometimes, there could be discord between family members and the patient, and patients could request to be the sole recipient of education. Effective peer learning can happen through many alternative fashions and methods. While there are many benefits to peer studying, there are additionally some drawbacks, including distraction and lack of respect for suggestions. It’s onerous to number all the advantages of peer learning, however a few of them embrace new views, extra social interplay, and deepened private studying.

Formative assessment displays studying progress whereas summative evaluation evaluates learning after instruction ends. Formative assessments sometimes serve as low-stakes exercises with minimal level worth, whereas summative assessments carry vital weight. Formative evaluation guides ongoing studying by way of actionable feedback, whereas summative assessment measures achievement towards established requirements. While nonetheless rising, VR/AR offers unparalleled immersive learning experiences. These tools permit multiple college students to contribute ideas, draw, and organize ideas concurrently, fostering real-time collaboration. As the primary YouTube video embedded on this article emphasizes, “Variety in Teaching Methods” and “Utilize Images and Videos” are crucial for catering to different studying types and preserving students engaged.

This interdisciplinary method aims to show the interconnectedness of different subjects and enhance the relevance of learning. Integrating advanced instruments into classwork permits students to acquire superior abilities. Engaging in particular person or group projects teaches time management, task prioritization, effective communication, collaboration, and different very important soft abilities.

It’s like a GPS for studying, constantly recalibrating to ensure students are on the best path. Integrating know-how isn’t about changing the instructor; it’s about empowering you to create richer, extra interactive, and deeply partaking studying experiences. It’s about meeting college students the place they’re and getting ready them for a future that is undeniably digital.

Inclusive school rooms use varied teaching kinds to assist all college students study. This includes supporting kids with special needs alongside their friends. Mix group work, individual duties, hands-on actions, and technology to reach totally different learners. Problem-based studying presents real challenges that require collaboration and important considering.

As we help students achieve data and expertise, we empower them and instill confidence. This newfound confidence paves the greatest way for optimistic outlooks that may result in a more peaceful society. This statement fantastically describes the essence of teaching—we shouldn’t simply fill students with data but inspire and ignite their passions. We should try to instill essential life lessons alongside normal curriculum necessities. By shaping our students’ minds and hearts, we can help them navigate life’s challenges and respect the bigger image of what really issues in life. This quote encourages us to focus not just on tutorial skills but also on character growth.

By permitting college students to attempt their arms at issues exterior of their consolation zone, it gives them a chance to see what they enjoy doing. Enable college students to take active engagement in new tasks with minimal steering. This will breed confidence once they enter new conditions, and they will be extra adaptable to prosper.

In current years, technology has turn out to be a pivotal pressure in reshaping the educating and studying dynamic. Digital platforms, online programs, and digital lecture rooms have made training extra accessible than ever earlier than. Students can learn at their very own tempo, revisit classes, and entry a wealth of resources that complement conventional educating strategies. In this way academics can create learning experiences that assist youngsters’s natural cognitive development and assist them construct a deep, significant understanding of the world around them. John Hattie is an influential education researcher well known for his research of the effectiveness of educating methods and techniques. Reflective practices serve as priceless instruments in promoting critical considering skills among students.

Added to the above externally-planned sequence, learners at the second are required to collaborate, with little choice with whom, for what objective, and at what stage of the educational and/or production/design process. This is a far cry from the early stages of creating studying via play where students have been simply given areas or time or ideas. Now, teachers are actually requiring particular collaboration with specific necessities and little choice–at least concerning the collaboration itself.

For extra interdisciplinary teaching activities and tips about the means to get started, learn 10 Interdisciplinary Teaching Activities and Examples Unit Design Steps. For more ideas about reciprocal teaching, read 4 Reciprocal Teaching Strategies to Use. For more experiential studying activities, read 7 Experiential Learning Activities to Engage Students. Provide college students with new ways of learning to help them keep centered, learn dynamically and be taught sooner. If you need more examples and methods for gamifying your classroom, learn How to Gamify your Classroom in 5 Easy Steps. For extra methods to follow psychological math skills, learn 12 Practices to Improve Students’ Mental Math Downloadable List.

Rather, floor studying must be the place to begin for deeper learning, which includes important thinking and problem-solving expertise. Overall, reflective practices improve important thinking by guiding students towards extra profound studying and understanding. By using learning stations, teachers can create a wealthy and responsive learning surroundings, the place the overwhelming majority of students discover ways to connect with the category material. Ultimately, PBL goals to boost pupil engagement and conceptual understanding.

Through utilizing notebooks and digital platforms, learners can engage in reflection, pinpointing areas needing improvement in their learning journey. These practices result in a deeper conceptual understanding and improved scholar performance. Learning stations present a dynamic methodology for participating college students in hands-on studying. This efficient instructional technique allows educators to deal with diverse studying types inside their lecture rooms. Each station provides distinct actions tailor-made to different preferences and wishes, making certain all college students receive priceless studying alternatives.

By guiding our students toward making use of knowledge in actual life, we equip them with the instruments necessary for effective problem-solving. We should attempt to inspire action that contributes positively to society, reinforcing the importance of education in shaping responsible citizens. This quote fantastically illustrates how academics hold the keys to transformation. With the right mixture of steerage and expectations, we will spark growth, resilience, and long-lasting change in our students’ lives. This quote displays that the impact we’ve as educators extends far past the classroom. Our teachings go away a lasting mark, shaping students’ lives well into adulthood.

This was fairly interactive and had plenty of good resources, curated to what you wished to achieve. My largest issue, however, is some of the assets are both slghtly dated or not obtainable. No coding, no problem, just stunning web sites, enhanced conversions, and complete control over your online presence. Each lesson must have its own goal and clearly contribute to delivering the specified outcome of the course. Your largest benefit as a trainer is that nobody else can educate fairly like YOU can. To promote your expertise effectively, work on mastering the artwork of speaking your ideas, and breaking complicated things down in ways that can be clearly understood.

The act of instructing and learning together cultivates a spirit of camaraderie and mutual help, leading to a collaborative studying environment. As educators guide and inspire fellow learners, a shared sense of feat and camaraderie blooms, strengthening the bonds throughout the studying neighborhood. By using a direct instruction teaching style, teachers present college students with an organized and structured environment from which to amass the foundational knowledge they need for more advanced subjects. This teacher-centered strategy permits all learners to profit from clear explanations as nicely as participating activities that help reinforce ideas taught throughout class. Demonstration instructing is a strong technique for bringing ideas to life in the classroom.

This feedback permits each students and educators to assess comprehension ranges and instructing methodologies. Engaging with scholar suggestions can reveal key insights into how teaching aids the training process. Assessment techniques similar to formal examinations or practical demonstrations can quantitatively measure knowledge gained.

Monitoring children’s progress allows educators to adapt based on each kid’s needs. A strong grasp of academic ideas enhances their capacity to help learning by way of play. Moreover, an educator’s positive angle in course of this method positively affects learning outcomes. Incorporating play into early math education makes studying an innate part of the game itself. While studying via play successfully builds mathematical abilities, it stays less explored than conventional strategies.

Sensitive intervention can improve play-based learning experiences. The effectiveness hinges on teachers’ beliefs and classroom practices, which might vary as a result of pressures and resources. Active, child-led learning performs an essential function in early education. This approach promotes not just tutorial skills but in addition socio-emotional development by way of play. Engaging children in playful experiences, like pretending to shop, enhances literacy, math, and social data, leading to raised academic outcomes over time.

In a language class, students could pair as much as follow conversational expertise. Each pair is responsible for teaching and correcting one another’s pronunciation, grammar, and vocabulary usage. This not solely provides additional practice for the scholars but additionally promotes a supportive studying neighborhood the place college students take an lively position in each other’s learning. Cloud computing instructing involves leveraging cloud-based technologies to enhance the learning expertise. This includes storing and accessing knowledge, collaborating on tasks, and using online instruments and resources for teaching and learning. The Jigsaw technique is a cooperative studying strategy where college students work collaboratively to turn into specialists on particular matters and then share their knowledge with their peers.

Differentiation means tailoring content material, course of, and product to scholar readiness, pursuits, and studying profiles. Use tiered tasks, learning stations, and choice boards to supply multiple pathways. Avoid monitoring college students into fixed capability groups; instead, flexibly group and regroup based on ongoing evaluation. Large classes, limited tech, and burnout are actual, but not insurmountable.

If you are trying to determine the means to train on-line in a method that actually works on your students and your business, this guide walks you thru every important step. The pupil is on his way, sometimes excitedly, sometimes reluctantly, to turning into a studying, changing being”. Ultimately the teacher will scale back the frequency of the constructive reinforcement to solely these responses of the very best caliber. No one stage is an efficient studying strategy by itself, for example, if the reflective observation stage is skipped, the learner may continue to make the same errors. Each stage within the cycle each helps and leads into the following stage. Learning is achieved only if all four phases have been completed, however, a learner might travel across the cycle multiple occasions, additional refining their understanding of the topic.

Building robust relationships also entails understanding students’ strengths and challenges. Tailoring your strategy to their needs promotes a more practical learning experience. By the time last fall rolled round, I had taken as many education courses as English programs, and I felt prepared to actually be in the classroom. And yet, pupil speak typically makes up lower than 20% of the time spent in science class, and of that small period of time, very little is concentrated on student sensemaking.

Tailor the tutorial journey to every student’s needs and watch their understanding deepen. It is important to note that the lines between most of these lectures can typically blur, as different instructors might have their own unique instructing types. The labels are used to provide a basic understanding of the assorted approaches to lecturing, but there may be variations or combos depending on the context and objectives of the lecture. They are continually thinking about their apply, analyzing what worked and what didn’t, and in search of ways to improve. It’s a cycle of steady improvement that can be supported by Instructional Coaching. The most effective academics are continually checking for understanding and adjusting their instruction accordingly.

Innovative approaches to education inspire college students to delve into new issues, utilizing varied instruments to broaden their horizons and foster a spirit of exploration. Integrates the event of soft skills, similar to communication, collaboration, and time management, essential for fulfillment in numerous contexts. A educating profession allows you to considerably influence students’ lives whereas having an outstanding work-life steadiness. Typically, it takes four years to amass a bachelor’s degree in training and become a teacher. Additional time is spent buying teaching experience by way of internships and taking licensing examinations. You’ll be expected to study the core pedagogical approaches to classroom instruction and management.

UDL provides completely different options for teenagers to meet learning goals and to point out what they’ve discovered. It makes it simpler for youths to work in the way that they be taught best in different topics. Kids do experiments, write down the steps, and report their findings. Many applications designed to help struggling readers include a multisensory approach (on prime of different components). The creators of the Orton–Gillingham strategy pioneered this way of educating. Programs that use Orton–Gillingham ideas use sight, sound, movement, and contact to assist children join language to words.

Moreover, instructing others encourages learners to revisit and evaluate content. By repeatedly participating with the fabric, each the trainer and the learner solidify their understanding, leading to increased confidence and mastery of the subject matter. The concept is grounded in various educational theories, including constructivism, which emphasizes that data is constructed through social interactions. As learners instruct one another, they not only convey information but also construct information collaboratively, thus enhancing their very own learning experiences. More than 300 colleges of education in the United States have created programs that stretch beyond the standard four-year bachelor’s diploma program. Some are one- or two-year graduate packages for recent graduates or mid-career recruits.

In education, VR can be utilized to transport college students to virtual worlds that simulate historic events, scientific phenomena, or complex ideas. For instance, students finding out historical past would possibly virtually discover historical civilizations, whereas science college students may conduct virtual experiments in an engaging studying surroundings. This technology enhances experiential studying, allowing college students to visualise abstract ideas and have interaction with subject material in a new way of educating.

{undefined}