This perspective typically results in elevated resilience and perseverance. Individuals with a development mindset tend to embrace challenges, persist within the face of setbacks, and see effort as a path to mastery. Successful individuals also study to delegate duties and say no to non-essential commitments. This permits them to give attention to high-priority work whereas preserving time for personal life. Delegating tasks is one other key facet of effective time management. Recognizing when to outsource or assign responsibilities to others frees up useful time for more important endeavors.

In today’s fast-paced world, attaining success is a universal aspiration. People throughout the globe try for fulfillment, however what sets the highly successful aside is their constant adherence to specific habits. In this article, we’ll explore the 20 key habits that profitable people share. These habits provide a roadmap to reaching your targets, whether or not they’re private or professional.

Sleep deprivation is strongly linked to irritability, anxiousness, impaired judgment, and melancholy. Chronic insomnia will increase the danger of developing long-term psychological health issues. On the opposite hand, healthy sleep patterns enhance emotional regulation, problem-solving, and resilience to stress. Mental health is the quiet basis upon which every and every other a half of our lives rests.

Watch out for turning into too busy with “good habits” that do not or now not serve your targets, improve well-being, or foster fulfillment. Through books, they entry a wealth of knowledge, experiences, and views beyond their very own. Reading turns into a day by day ritual, feeding their minds with inspiration and wisdom. If you desire a habit to stay, make it something you really look forward to. We’re all much extra likely to repeat issues that really feel good, so strive adding somewhat pleasure to no matter behavior you’re building.

Start with just one habit at present, whether it’s practicing gratitude, setting a small goal, or limiting negativity. Over time, these small modifications will add up, and you’ll discover a big difference in your capability to deal with life’s ups and downs. Simply put, it’s the ability to bounce again from setbacks, keep calm underneath stress, and hold striving toward your goals it doesn’t matter what life throws at you.

Celebrate your accomplishments, no matter how small, to remain motivated and reinforce positive study habits. We encourage readers to begin adopting profitable habits of their lives. By following the ideas we’ve provided and staying committed to their targets, they can make optimistic changes that can help them achieve their goals.

This characteristic permits individuals to change their psychological habits, reinforcing the chance of private development and transformation. When a person consciously decides to change a mental behavior, they engage in a course of that includes both recognizing current neural pathways and training new behaviors. By doing so, they will effectively ‘rewire’ their brains, fostering optimistic habits that contribute to a greater and more fulfilling life. Developing a growth mindset is doubtless considered one of the most powerful approaches to enhancing personal and professional improvement. A growth mindset encourages people to embrace challenges, be taught from feedback, and persist through setbacks.

This easy switch not solely satisfied her snacking habit but also contributed positively to her health—demonstrating the impression of efficient habit formation strategies. Many people assume that altering habits is a one-time event, one thing that can happen in a single day. While this might be true for some, studies by Dr. Phillippa Lally from the University College London counsel that the average time is nearer to sixty six days! So dont get discouraged in case your new strategies for achievement appear to take longer to stay. Journaling helps profitable people establish patterns, clarify objectives, and strategize next steps.

They shield their sleep schedules and create environments conducive to high quality rest. Exercise is not nearly physical fitness—it’s a stress reliever, creativity booster, and confidence builder. Many profitable people schedule workouts like important conferences, making them non-negotiable elements of their routines. Highly successful individuals perceive the facility of relationships and make investments vital time in constructing their networks.

Comparing yourself to skilled or seasoned speakers creates unrealistic expectations and may erode confidence. Instead, measure progress solely in opposition to your personal place to begin. Focusing in your journey lets you rejoice incremental wins, avoid unnecessary self-criticism, and reinforce confidence in your distinctive skills. Physical activity boosts vitality, reduces stress, and sharpens psychological readability; all important for long-term success. You don’t need to hit the gym daily; even a 10-minute walk could make a distinction.

This is consistent with the decrease improve in behavior energy later on during the research interval. We examined the information in SPSS 24 with the Linear Mixed Models, utilizing Maximum Likelihood estimation. In the first analysis, we carried out a progress curve modeling for habit formation, in which a random intercept, and glued results of a linear and a quadratic time trend were estimated. In addition, the random slopes of the linear and quadratic trend were tested to permit for particular person differences within the growth curve.

Social and environmental elements, such as peer influence, social gatherings, and cultural norms, can also affect college students’ consuming behaviours. Pressure to conform to unhealthy consuming habits, social events focused around food, and promoting of unhealthy meals can affect college students’ dietary choices. The final objective of vitamin education initiatives is to assist students adopt healthy consuming habits by transferring their data and good attitudes into motion.

A sturdy work ethic is a defining characteristic of extremely profitable individuals. They are dedicated and committed to their endeavors, and this work ethic is a key driver of their achievements. They perceive that sufficient rest is crucial for cognitive operate, mood, and total well being. By consistently getting enough sleep, they ensure they’re in peak condition to sort out their every day challenges.

Long-term objectives function the overarching visions individuals aspire to achieve throughout their restoration journey. These objectives sometimes mirror overarching aspirations like emotional resilience, improved relationships, or sustaining psychological well-being post-treatment. To illustrate the ability of consistency, let me share a personal story. After spending a long time within the hospitality trade, I knew it was time to begin out my very own business. But before diving into this new enterprise, I realized that I needed to make some personal changes first—I didn’t want to carry my old habits and mindset into my new life. Long-term rehabilitation provides the time and house to discover these areas thoroughly.

In essence, mastering mental habits just isn’t merely an train in self-discipline but a significant step toward reaching a extra fulfilling and purpose-driven life. By understanding the psychology behind behavior formation, we can take management of our behaviors and, in flip, our lives. Whether breaking dangerous habits that hold you again or building constructive routines that propel you forward, the facility to change lies in your hands—and your mind. As the philosopher and historian Will Durant famously said, “We are what we repeatedly do. Excellence, then, just isn’t an act, however a habit.” Success is more than just a product of hard work and skill; it stems from cultivating the proper mindset.

The journey toward psychological wellness is ongoing, and external sources play an important role in supporting sustained progress. These goals would possibly include working towards mindfulness, enhancing sleep habits, strengthening relationships, or managing stress, all of which positively influence your holistic health. Regularly evaluating and adjusting your goals helps keep balance and addresses completely different dimensions of wellness, such as social, spiritual, and environmental features. Mental well being targets should be built-in into your overall wellness plan by concentrating on physical, mental, and emotional well-being simultaneously. Setting SMART goals—specific, measurable, attainable, related, and time-bound—ensures clarity and progress tracking, making it simpler to remain motivated and accountable.

Emotional intelligence is a pivotal habit amongst extremely successful individuals. They understand that the power to understand and manage feelings, each their very own and those of others, is essential to constructing sturdy relationships and efficient leadership. Furthermore, they know that persistence is often the important thing to success.

Lastly, adapting strategies as your life circumstances evolve is key to sustaining momentum. Recognize that circumstances change and, consequently, some mental habits might have to be reevaluated or adjusted. Remaining flexible in your method permits you to successfully integrate new methods that align together with your current needs. By sustaining a concentrate on personal development and adjusting practices accordingly, you’ll create a sturdy framework for lasting positive change.

They view failures as valuable classes and make changes based mostly on these experiences. This continuous cycle of studying and adapting permits them to turn into even more efficient of their pursuits. Mindful awareness offers individuals with the chance to pause and make intentional choices rather than reacting instinctively. Joining support teams or finding an accountability partner can improve motivation. Such connections foster a way of shared function and understanding.

As such, participants had been intrinsically motivated and there was room for forming a new behavior. Self-discipline is not a one-time act however an ongoing practice, requiring consistent effort and dedication. It’s a journey that transforms not only your external achievements but also your inside character.

Long-term pondering often requires taking a step again from our every day lives and contemplating how our actions today will have an result on us in the future. However, this can be difficult after we are continuously bombarded with distractions and stress. That’s why working towards focus and mindfulness could be extremely useful for bettering long-term thinking. Long-term considering is the practice of planning and strategizing for future goals as a substitute of simply reacting to immediate wants or desires.

A sturdy concentrate on individualized care not only enhances engagement but also aligns therapy with what matters most to the shopper. Every individual’s journey with addiction is unique, and long-term rehabilitation allows for extremely personalised remedy plans. Professionals can monitor progress over time and modify remedy, coping strategies, and life abilities training to fit every participant’s evolving wants. Extended care permits remedy teams to deal with setbacks as they occur and supply individualized interventions tailor-made to every person’s progress.

Working together with others strengthens resolve and fosters a positive environment for change. Aim to perform your chosen habit day by day, striving to not miss greater than two consecutive days. Creating a consistent set off or routine, corresponding to brushing your tooth after meals as a reminder to floss, can further reinforce the behavior.

Programs like Anki or Quizlet can schedule evaluations for you, making monitoring your progress simpler and making certain you revisit the material at the optimal time. Incorporating spaced repetition into your research routine will allow you to retain information extra effectively and cut back the necessity for last-minute cramming. Your study surroundings significantly impacts your capacity to pay attention and retain data. Research exhibits that learning in a well-lit, quiet, and arranged space boosts focus and reduces distractions, permitting you to course of information extra effectively.

Think about what you’d like to accomplish within the next few months or yr. Astrology helps mental and emotional well-being by encouraging self-awareness, stress administration, emotional regulation, and mindfulness. Zodiac-based self-care targets assist individuals maintain balance and cut back emotional burnout. Engaging in common physical activity performs a significant role in enhancing psychological wellness. Exercise has been proven to spice up mood, scale back nervousness, and improve cognitive perform.

Differentiating your identity from efficiency may help you bounce again from criticism and setbacks, fostering resilience. This interconnectedness not solely supports individual success but additionally promotes mental well-being, creating a virtuous cycle of development and achievement. The mentally tough don’t take it personally when issues don’t go the means in which they deliberate. They acknowledge that they are not entitled to automatic success and that it takes onerous work, planning, execution, and luck. It doesn’t cease them, as they really feel that eventually things will end up in their favor if they hold attempting and refuse to give up.

Consider joining a writing group or finding a mentor in your area who can supply guidance and suggestions. Regularly review and regulate your tasks and deadlines as needed to stay on monitor. Effective communication is the cornerstone of any profitable relationship. This means not solely sharing your thoughts and emotions but also actively listening to your companion or liked one. Consider implementing regular check-ins where each events can specific their emotions and discuss any issues that may have arisen.

Self-compassion includes treating yourself with kindness and taking breaks whenever required. Whenever we face shortcomings, we both are inclined to blame ourselves or numerous components round us, neither of which are helpful. Do not let both of those get into your head and hamper your progress. Appreciate and reward efforts and small progress that you achieve along the method in which. Align with reflection by yourself, seek constructive criticisms from others, and inculcate them into your thought pattern.

It’s about incorporating small, manageable habits into your daily life. By being in maintaining with even the only actions, you set your self up for long-term achievement and private growth. So, begin small, be affected person, and enjoy the journey as you work toward making a life you actually love.

The only thing that this type of career success requires is discipline, which is crucial for advancement. You must consciously have interaction in actions that can compound and achieve the long term. And the reality is you need to work daily for years before you turn into profitable in life. At the core of consistency lies the flexibility to ascertain and keep daily habits that support one’s ambitions. Research revealed in Brain Communications means that lifestyle and mental wellbeing significantly influence mind getting older.

We are required to abide by the terms of this Notice for so lengthy as it stays in effect. Whether it’s sharing a workload, seeking advice, or just speaking through your feelings, leaning on others can make a big distinction. Pause and breatheWhen everything feels too much, the very first thing to do is pause. Inhale deeply via your nostril, maintain it for a second, and exhale slowly by way of your mouth. This simple follow helps calm your mind, slows your heart fee, and provides you a moment to reset.

By sustaining a long-term perspective, you’ll have the ability to stay focused on your goals and appreciate the progress you make over time. In addition to daily monitoring, conducting weekly and month-to-month critiques is important for assessing your progress and figuring out tendencies. During these critiques, reflect in your successes and challenges, and make any necessary changes to your habits or tracking methods. Regular evaluations allow you to keep targeted in your targets and ensure that you are making continuous progress.

By adopting new methods of considering, individuals can navigate challenges extra effectively and seize opportunities they may have beforehand ignored. Simple every day practices typically carry a lasting influence when sustained across months and years. These habits ground the mind and physique, offering predictability and calm. One approach stands out by way of practical routines that fit into various lifestyles. Durable success isn’t just setting objectives and carrying out goals—it’s being in the right thoughts. For distant and hybrid work groups, the proper mindset can alter the means in which they strategy challenges and work together.

Let’s explore these challenges and provide strategies to overcome them backed by analysis and professional opinions. Similarly, constant dietary habits play a important role in health. The Center for Healthy Eating and Activity Research at UCSD emphasizes the significance of every day decisions about what we eat to maintain good well being.

Failure is not something to worry, however somewhat something to embrace as part of the journey towards success. Over time, focusing on what’s going properly creates a mindset of abundance and chance. Rachel toiled as a advertising government but had to grapple with the persistent anxiety at her office and thus felt the strain of the situation. She integrated every day meditation, writing, and morning walks into her schedule. With time, she turned the one in charge of her thoughts and feelings. Currently, she is main a not hectic life and can additionally be contented along with her work and personal life.

With their ability to help cognitive function and psychological vitality, nootropics like Mind Lab Pro can help ensure you keep constant in your efforts, even when the journey feels lengthy. Maintaining good mental well being doesn’t happen just once; as an alternative, it is the means of a lifetime that calls for consistency. Equipping little conscious habits every day in your schedule might help you overcome stress, cope with and recover from stress, or purchase a extra constructive perspective. Daily habits to assist long-term psychological wellness involve setting boundaries, nurturing relationships, and taking time to relax and recharge. Adopting the best mindset is essential for maintaining daily habits.

Rather than feeling threatened or jealous, use their achievements as motivation and study from their experiences. Recognize that success just isn’t a set quantity and others’ accomplishments don’t diminish your individual potential. Instead of taking it personally, use constructive suggestions as priceless information to information your growth and improvement.

Over time, patterns turn out to be clearer, making it simpler to respond rather than react. Therapy encourages self-reflection via dialogue, journaling, or guided workouts that deepen consciousness of ideas and feelings. This regular follow supports resilience throughout stress and change. Many folks discover that long-term remedy evolves with their wants, shifting focus from disaster help to personal growth and relational perception.

This follow encourages mindfulness and appreciation for life’s necessities. Clear objectives assist break down bigger aspirations into manageable steps. By figuring out concrete actions, people can create a roadmap for progress.

Finally, cultivating a way of purpose—whether through work, volunteering, or private projects—helps people feel priceless and motivated. Combining these behaviors creates a holistic method to mental health, reinforcing resilience and total well-being through interconnected way of life choices. Stay targeted and disciplined, even when faced with challenges or setbacks. Prioritize your duties and handle your time successfully to make the most of every single day.

The environment during which you live and work performs a crucial function in shaping your habits and behaviors. By deliberately designing your surroundings to assist your required habits, you can dramatically increase your probabilities of success. You might must experiment with completely different approaches, adjusting the specifics of the cue, routine, and reward till you discover a mixture that really resonates. The key is to start small, construct momentum, and gradually improve the complexity and problem of your habits over time. Identifying and understanding these behavior triggers is a crucial first step in the path of building the highly effective routines that will propel you in the path of your long-term targets. Since those who are profitable use a lot of mind energy to make essential choices, it’s essential that they invest in their psychological well being so they can continue to concentrate on what’s essential.

Set aside time weekly or monthly to evaluate what you’ve achieved and what still needs attention. This assessment can help you establish areas where you’re excelling and areas that may require extra focus. By understanding your progress, you probably can have fun your achievements and keep motivated to continue shifting forward.

This contains medical assessments, dietary planning, counseling, and conversations with specialists who help determine the most applicable method. These preoperative steps create a robust foundation that results in safer surgery and better long-term outcomes. Embracing self-compassion helps scale back emotions of frustration and keeps motivation high. Using instruments such as journaling or cellular apps can considerably enhance progress monitoring. Journals permit for deep reflection on ideas and emotions, whereas apps present reminders and visible progress charts, maintaining motivation high and accountability strong.

Also, gratitude or meditation habits can foster a positive mindset and improve emotional resilience. Regularly tracking progress helps people keep conscious of their achievements and areas needing enchancment. Several components significantly impact the formation of habits, such as the surrounding context, emotional states, and social influences.

Over time, these practices will contribute to a more optimistic outlook on life, culminating in improved psychological and emotional well-being. Recovering from addiction is a profound journey that calls for extra than simply ceasing substance use. Key to this journey is cultivating a constructive mindset, which is pivotal for long-term recovery. Positive considering not only retains you motivated but in addition fortifies psychological health and resilience in opposition to setbacks.

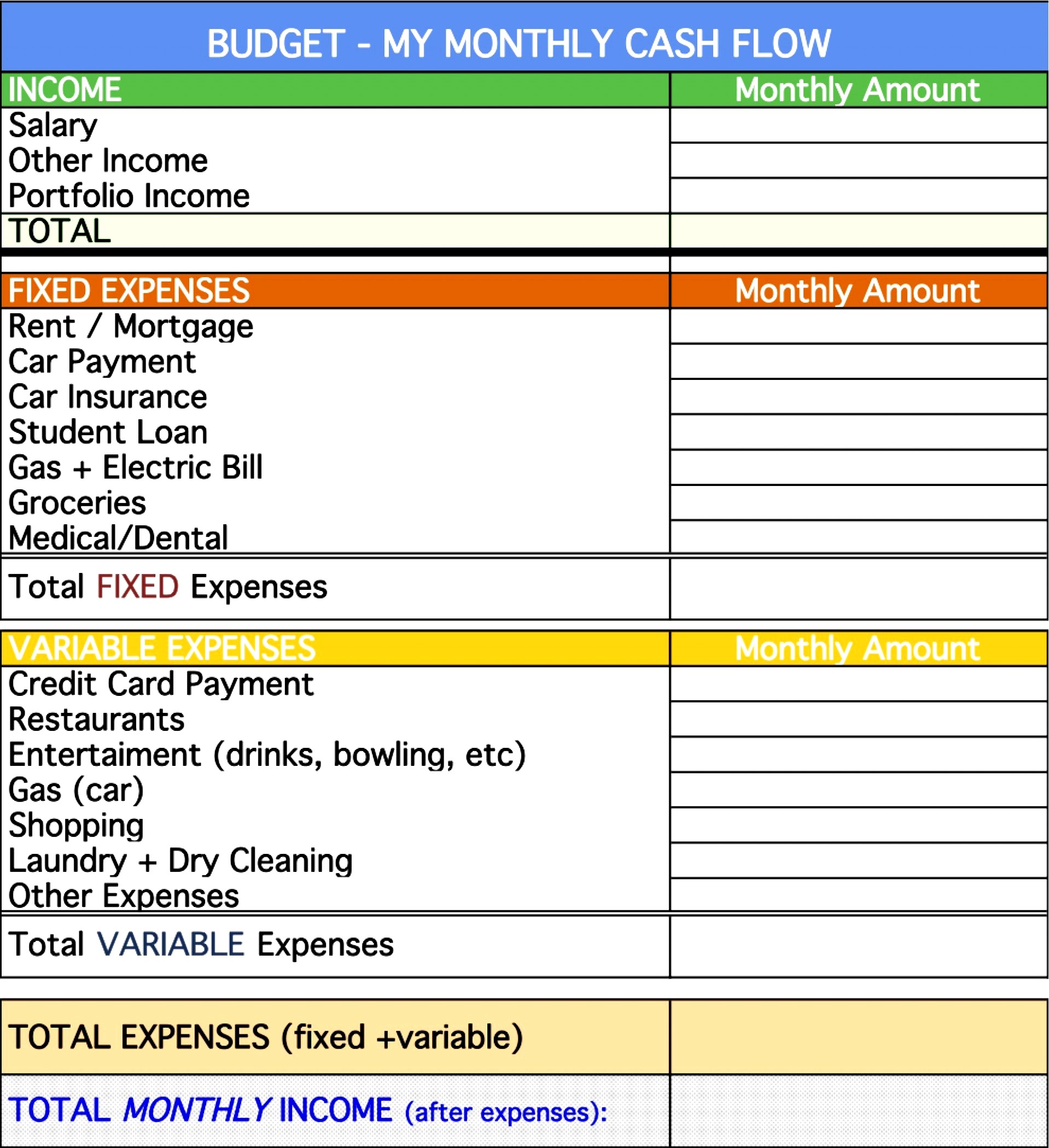

Remember, failure isn’t the top; it’s a possibility to be taught, adapt, and in the end achieve your long-term aspirations. For occasion, in case your aim is to turn into a printed author, write down what meaning to you. Is it publishing a novel, a collection of articles, or a non-fiction book? She has a steady job with an annual salary of $60,000, scholar loans totaling $20,000, and bank card debt of $5,000. After creating a finances, she identifies that she will save $500 per 30 days. Who discuss failure not as one thing shameful, but as one thing needed.

The goal is “improved health,” but the habit involves getting up at a particular time day by day, putting on running shoes, and heading out the door. The rewarding feeling of accomplishment or the endorphin increase serves as optimistic reinforcement. Apps like Strides and Habitica have successfully leveraged this framework by providing visual progress trackers and gamified rewards, motivating customers to sustain their routines. In today’s fast-paced world, private progress and self-improvement have turn out to be more and more important as we try to turn into the best versions of ourselves.

Seek out stories of success and perseverance in your subject of examine. One of the most effective suggestions for continuous study motivation is to break your duties into smaller, extra manageable steps. This strategy, often recognized as “chunking,” helps scale back overwhelm by making your study goals appear extra achievable. Each small victory builds momentum, reinforcing your motivation to sort out the subsequent task.

The journey of private development can be difficult and isolating at occasions. That’s why TNT incorporates collaboration options, allowing customers to connect with a coach or companion for steerage, help, and accountability. This social support not solely helps users keep motivation but additionally increases the likelihood of reaching their private growth goals.

Practicing mindfulness is an efficient technique for fostering a optimistic mindset during restoration. Techniques like mindfulness meditation might help you manage stress and cravings. Simple exercises similar to deep respiratory can ground you, lowering nervousness levels and enhancing emotional regulation. By cultivating these habits and others like them, we will create a powerful basis for long-term success and fulfillment.

The Brown University Health Blog Team is working to give you timely and pertinent information that may assist hold you and your liked ones happy and wholesome. You might have heard it only takes as little as three days to kind a new habit, but that will not be fairly enough time. For instance, flossing your tooth frequently is nice for your well being. But if you skip flossing, that’s a nasty habit as a result of it could possibly have unfavorable effects in your well being.

Even when you’re having a tough day, you might be aware of what you should do to search out peace. Assessing your feelings and understanding yourself might help you retain a relaxed angle even during instances of disaster. It’s not about what others have to say about you; it’s what you have to say about your self. We all face challenges every day, but when you are firm and resolute about your desires, you will achieve the belongings you want most. A multitude of studies over a few years have mined well being knowledge on this similar cohort.

They then prepare a game plan with benchmarks to hit over a time frame. They stick to the plan and work like crazy to meet the deadlines. They ignore all the haters and negative people who want them to fail. In this episode, I describe science-based protocols to set and obtain your objectives in a means that maximizes the chance of reaching them.

This phenomenon relies on reward-based studying, the place pleasurable outcomes strengthen the behavior. Emotions and motivations considerably affect how habits type. Positive reinforcement strengthens the habit loop by incentivizing them to proceed the conduct.

By adopting habits for better health, folks can lower their risk of big health issues like weight problems and diabetes. Keeping a diary of food and actions helped me stick to my health goals by up to 45%. By understanding this cycle, you can begin intentionally designing habits that assist your long-term goals. In this post, we’ll talk about the ability of day by day habits, the means to construct them, and how small, constant actions can lead to massive outcomes over time.

Factors like genetics, training, and occupation also play a role. Though,this examine emphasizes the substantial affect of modifiable lifestyle components. While the study doesn’t define “brain age” precisely, it likely refers to a composite measure derived from neuroimaging information (such as MRI scans) that assesses mind structure and performance. Differences in “brain age” compared to chronological age counsel a faster or slower rate of age-related cognitive decline.

These cues present a visible illustration of your progress and function a reminder of your commitments. Placing visible cues in outstanding places, similar to your workspace or home, helps keep your habits top of mind. Habits are routines or behaviours carried out often, typically unconsciously. According to Charles Duhigg’s “The Power of Habit,” habits form by way of a loop of cue, routine, and reward.

Be trustworthy with yourself about what led to the setback, and think about whether or not changing your approach might help you stay more on monitor. As you repeat the new habits, the impulse to observe the brand new routine develops. Eventually, after you see rewards from the new behavior — more vitality and less of a sugar crash — the urge to keep doing this habits would possibly outweigh the will to pursue the old habit. Mindfulness might help you develop awareness round your thoughts, feelings, and actions. This follow entails merely observing impulses that relate to your behavior with out judging them or reacting to them. Breaking undesirable habits can be tough, particularly if you’ve been participating in them for a very lengthy time.

Active recall is doubtless one of the most effective study methods for improving memory and retention. By actively retrieving info from memory, you reinforce and strengthen the neural pathways that allow you to recollect it later. Instead of passively re-reading notes or textbooks, test your knowledge by quizzing yourself or explaining ideas in your personal words. Research constantly exhibits lively recall students carry out higher on exams than these relying solely on passive evaluation methods. But bear in mind, self-discipline is the muscle you should implement and maintain this effective structure. In his spare time, Chris enjoys music, health, plant-based nutrition and provoking others to take constructive action steps and catch their very own goals in life.

By embedding habits into your routine, they turn out to be a pure a half of your day, making it simpler to stay with them. And belief that every step—no matter how easy, is constructing the life you want. Let’s dive in and unlock the day by day practices that lead to lifelong success.

Practicing mindfulness actions like meditation, deep breathing workout routines, or simply taking observe of your surroundings can significantly reduce stress. Even spending ten minutes journaling or engaging in sluggish, focused movements may help heart your thoughts and foster emotional consciousness. Social support and significant relationships serve as crucial buffers in opposition to stress. Connecting with pals, family, or neighborhood teams not solely supplies emotional backing but in addition fosters a way of belonging and purpose. Engaging in shared actions like volunteering enhances self-worth and neighborhood ties. Collaborative study sessions can provide new perspectives and improve your understanding of challenging ideas.

This means your mind must join your behavior to a constructive expertise. One of the strongest predictors of habit success is using contextual cues. In competitive job markets, perseverance could be the differentiating issue between candidates. Those who proceed to improve their skills and seek alternatives despite setbacks usually have a tendency to achieve their career goals. Regular mindfulness exercises, corresponding to meditation or deep respiratory, can cut back stress and nervousness.

Furniture that wobbles, wears down shortly, or feels temporary undermines consistency and self-discipline. When your workspace is anchored by well-crafted, sturdy items, it reinforces a mindset of dedication and intention. The key to choosing the individuals you spend the most time with is ensuring you choose these exponentially superior to you in a quantity of methods.

Exercise, as an example, is well known for its mood-boosting effects, because of the release of endorphins. Healthy consuming habits can have an result on mind health, influencing mood, energy, and cognitive operate. Mindfulness and meditation may help manage stress, But they also help to scale back symptoms of psychological health conditions like anxiousness and despair. In conclusion, this narrative evaluate underscores the intricate interplay between nutrition and educational success among university college students. Furthermore, the evaluation identifies barriers to healthy eating and suggests strategies for universities to create environments that foster healthy dietary behaviours.

However, sustainability lies in adapting these ratios to non-public tolerance levels. For instance, some individuals thrive on a higher protein consumption (up to 30%) with out exiting ketosis, whereas others might must strictly limit carbs to beneath 20 grams every day. Tracking macros utilizing apps like MyFitnessPal or Cronometer can present clarity, however the objective is to eventually intuit portion sizes and meals selections with out inflexible measurement. As you persist through challenges and setbacks, in search of ways to improve and develop, you set an example for others in your life. Your persistence can encourage relations, friends and colleagues to likewise challenge themselves and push by way of difficulties.